Alleged ‘predatory lenders’ which target those struggling to help make ends meet, have now been excluded through the performing fund that is best in the IA Sterling Corporate Bond sector.

Bryn Jones, whom operates the ВЈ1.1bn Rathbone Ethical Bond fund, has stated he will maybe not spend money on organizations involved with just what he considers become practice of lending at exactly what he deems interest that is excessive.

Mr Jones’ investment could be the top that is absolute away from 73 funds within the IA Sterling Corporate Bond sector in the last year, contending against both other ethical and non-ethical funds.

When you look at the 2017 calendar year he came back 9.8 percent, versus the sector return of 4.8 percent.

The investment is run using the principle that any investment must pass a screen this is certainly good that is, the organization issuing the bonds needs to be been shown to be involved in company task who has an optimistic effect on the planet.

A possible investment must additionally go through a “negative display screen” to demonstrate its company is maybe not particularly involved with a task this is certainly damaging to culture.

Exactly what Mr Jones calls “predatory financing” happens to be formally added as being a negative display, having formerly simply been an option.

Mr Jones stated offered the exemplory instance of Provident Financial, a home credit provider and payday advances company often referred to as a “subprime lender” advancing cash to poorer individuals at greater interest levels, which he has excluded from their investment.

Provident Financial’s share cost fall within the year that is past ВЈ29 to ВЈ9.30 showed how excluding an investment on ethical grounds might help an investor avoid mistakes, Mr Jones stated.

Neil Woodford, whom operates the ВЈ6.8bn Woodford Equity money investment, continues to be a significant investor in Provident Financial. He stated Provident provides lending in a component for the market that’s not offered by banking institutions.

The Royal community for Public wellness this week branded payday advances the “unhealthiest” form of credit. The organization stated customers with a pay day loan are prone to feel depressed.

“One basis for this is actually the вЂpoverty premium’ – the system whereby the poorer you might be, the greater amount of you spend products or services, including credit,” the organization stated.

“It is currently all too prevalent to see individuals in adverse conditions, usually with low incomes and insecure employment, forced into taking out fully loans with punishingly high interest levels given that best way making it until the pay cheque that is next.

“This system forces the essential susceptible within our culture further into an inescapable spiral of financial obligation – with all the associated injury to overall health, as illustrated by our report, that goes along side it.”

The Financial Conduct Authority (FCA) has warned in regards to the known degree of high priced unsecured debt being used in the nation such as for example bank cards, which generally charge greater interest levels to people that have poorer credit records.

Standard lifetime’s recently launched British Equity influence investment doesn’t have screen that is specific to financing, but does focus is on work.

Predatory Lender Elkins Uses His capacity to Keep Texans In is pocket

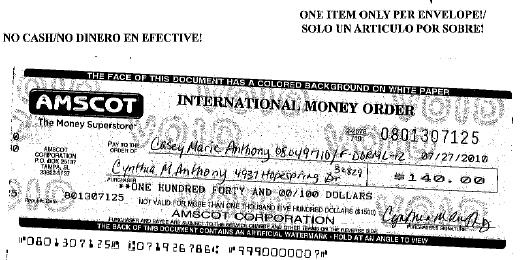

Image from HBO’s “Last Week Tonight with John Oliver” Corporations victim in the most economically disadvantaged individuals in America through payday financing. Payday financing is just a “ short-term, high price loan , generally speaking for $500 or less, this is certainly typically due on the next payday,” in line with the customer Financial Protection Bureau. The thing is when you skip payment, the attention repayments and charges may be impractical to satisfy. A Washington Post investigative report discovered payday financing organizations usually target poor people, providing an instant fix for folks who can scarcely keep their minds above water. One individual interviewed by the Post utilized a $1,200 check from Mariner Finance to correct their vehicle, that he had a need to get to the office and transport their young ones to college. Not even after, the ongoing business sued him for $3,221.27. Payday financing businesses demonstrably understand the ethics behind their main point here. “ It’s basically a means of monetizing the indegent ,” a former worker of Mariner Finance told the Washington Post, commenting in the company methods of this payday financing industry. Therefore it’s worrying whenever an owner of payday businesses is mixed up in Texas Legislature, voting against bills that could protect customers from predatory methods while shopping for his interests that are own. Texas Rep. Gary Elkins (R – Houston) are the owners of energy Finance Texas, a lending that is payday which lists 10 places across five metropolitan areas in Texas, including Houston, Dallas and San Antonio . On your behalf, Elkins has utilized their legislative capacity to block payday financing laws throughout the 2011 and 2013 legislative sessions. Particularly, Texas Rep. Vicki Truitt (R – Keller) authored three bills targeted at protecting loan that is payday, which Elkins opposed. “Isn’t it real which you stay to enhance your individual wide range dramatically by killing the bills?” Truitt asked Elkins when it arrived time for you to vote in the bills, in line with the Houston Chronicle. “Mr. Elkins, do you realize the style of conflict of great interest?” Elkins himself has admitted he makes use of their place within the Capitol to guard their interests that are own . The lawmaker’s antics caught nationwide attention whenever HBO host John Oliver highlighted Elkins as being a prime exemplory instance of the predatory methods of this payday financing industry.

State Rep. Gary Elkins has a string of predatory lenders that are payday Texas and routinely makes use of their energy within the legislature to quit laws regarding the industry. Elkins’ blatant conflict of great interest even caught the interest of a week ago Tonight with John Oliver. Find out more: published by Reform Austin on Tuesday, July 24, 2018

“Oh do I’m sure it?” stated Oliver mocking Elkins, after playing a  clip of Truitt asking if Elkins had been knowledgeable about the expression conflict of great interest. “Why madam, i will be the real embodiment of the term only at that extremely minute.”

clip of Truitt asking if Elkins had been knowledgeable about the expression conflict of great interest. “Why madam, i will be the real embodiment of the term only at that extremely minute.”

Another Houston Chronicle article states Elkins’ Power Finance shops in Houston, Dallas and San Antonio are cited for allegedly “not registering using the metropolitan areas or enabling regulators to examine their publications .” Then-Dallas City Councilman Jerry Allen stated it well whenever Houston Chronicle asked for their undertake Elkins’ obligation being a lawmaker but failure to check out laws being a businessman: “right here you have got a lawmaker that produces guidelines for everyone else, after which when considering time for him to adhere to what the law states that other folks follow, he thumbs their nose at it. We’re perhaps not likely to tolerate it.” No state lawmaker should make use of their legislative position to shield their companies through the legislation, while fattening their wallets from the suffering of hard-working Texans.